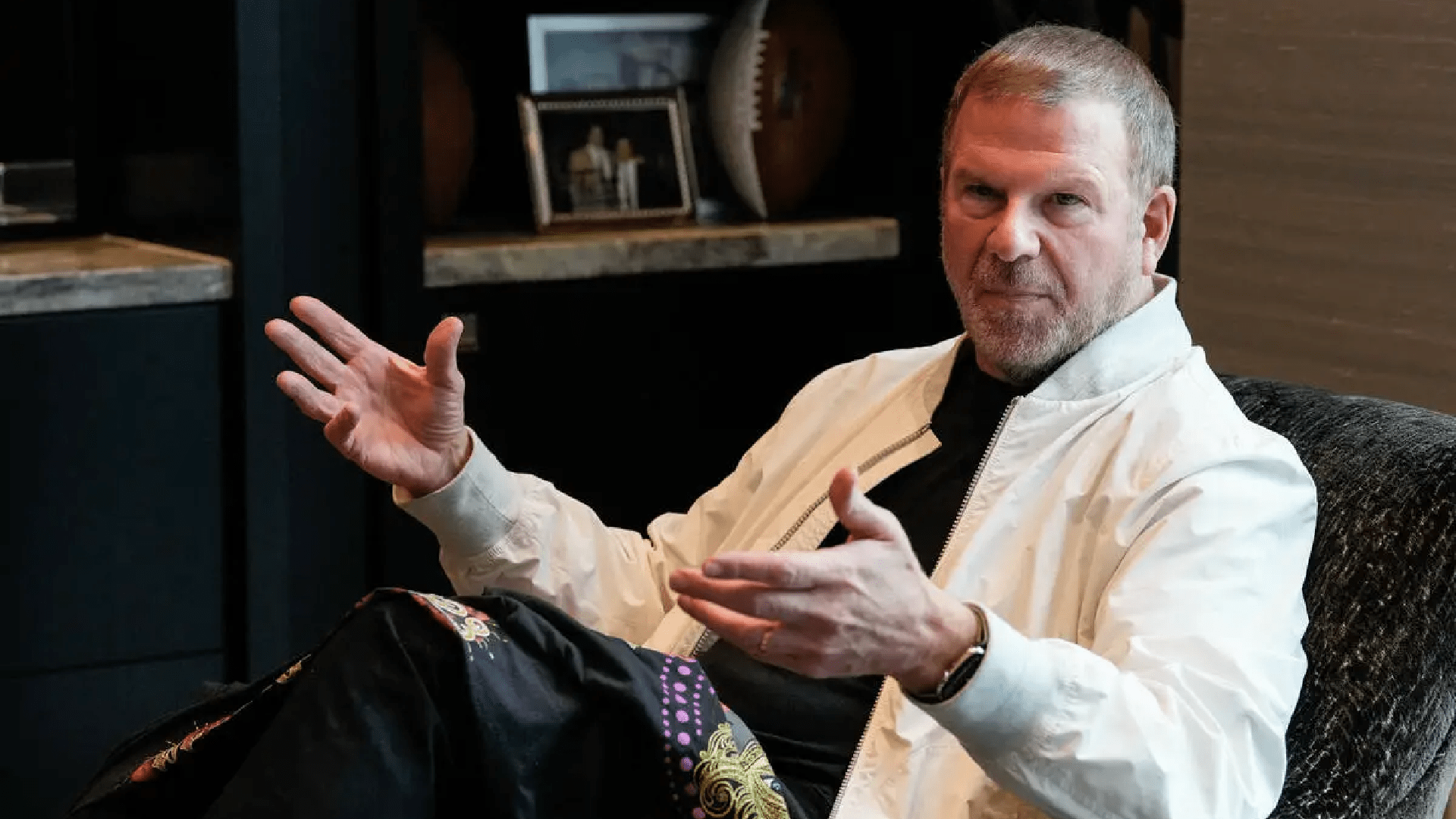

Tilman Fertitta raised his ownership in Wynn Resorts (NASDAQ: WYNN) to almost 10% of the total shares, but one analyst suggests that the Golden Nugget CEO probably won't seek to acquire his competitor.

In a recent report to clients, CBRE's John DeCree indicated that Fertitta is expected to stay a passive investor in Wynn, even though he raised his stake in the casino company to 9.9% in the third quarter, an increase from the 6.1% he held after his initial investment in the gaming firm two years prior. The announcement of the increased investment caused Wynn shares to rise by 8.65% on Thursday, partly due to Fertitta's history of acquisitions.

"We can appreciate the speculation, particularly given Fertitta’s mergers and acquisitions track record, including the acquisition of Morton’s Restaurant Group and McCormick & Schmick’s, both of which started with 13G filings and culminated in full takeovers,” wrote DeCree.

It was a 13G submission that disclosed Fertitta's larger stake in Wynn. If it had been a 13D, it would have indicated his intention to be an activist shareholder, advocating for changes at Wynn, possibly including a sale.

Fertitta Acquisition Theories Are Credible, Yet…

Merging Fertitta's track record of acquisitions with his Wynn investment nearing 10%, it’s clear why discussions of a takeover have reemerged.

A ten percent stake is a point where any company must pay attention to the investor with that share. Nonetheless, listening and appeasement frequently represent two distinct concepts. Additionally, there are numerous instances of investors obtaining significant shares in companies while staying inactive. Warren Buffett’s Berkshire Hathaway serves as a leading example of this.

Fertitta has earned a significant sum from his initial investment in Wynn. DeCree stated that the stock has risen by 70% since that role was disclosed. The Houston Rockets owner may prefer not to disrupt a successful formula by becoming an activist, yet he also recognizes the greater potential for profit in the shares.

“We view his recent move similarly, as an attractive value investment that could become strategic if a unique situation arises, such as an unfavorable economic cycle that results in further dislocation in the shares,” added the CBRE analyst.

Wynn Takeover Presents Numerous Complexities

Although Wynn might appeal to Fertitta or other potential buyers, there are complexities that must be taken into account. These consist of overseeing gaming licenses in Macau and the proposed casino hotel development in the United Arab Emirates (UAE).

Those are elements not relevant to certain Wynn rivals and may indicate that if Fertitta seeks to drive change at the Encore operator, it might do so in a more strategic manner instead of via an outright acquisition.

Last week, rumors emerged suggesting that Fertitta thinks Wynn management is failing to effectively communicate the stock’s performance — it has outperformed rivals for over a year — to shareholders and that the company might want to think about expanding its esteemed brand in the US. At present, the operator’s exposure in the US includes the Wynn/Encore complex on the Las Vegas Strip and Encore Boston Harbor, although the company is applying for a gaming permit in New York City.

Check Out This Bonus

Luck Land

- Relatively low wagering requirements on bonuses

- Attractive instant-play software

- Quick withdrawals

New players only 18+. Min deposit £20. 40x wagering applies to match up bonus . Offer valid for 1 week. 50 Spins on Starburst. 40x wagering applies to Spins.